Thursday, April 30, 2009

Busy Month

63 posts (not including this one) marks a new monthly record. Please let me know if there are any topics that I am leaving out or drop me a line if you disagree with my take on things.

markafz@gmail.com

Thank you,

MK

markafz@gmail.com

Thank you,

MK

Market Cap Re-Cap

Those Were The Days.........

April 30, 2009: Chrysler LLC files for bankruptcy protection under Chapter 11

January 7, 1980: President James Earl Carter signs the Chrysler Corporation Loan Guarantee Act of 1979, providing the company with $1.5 billion in backing. This enables the company to avoid bankruptcy.

Also:

- I was a just about a week past my 8th birthday

- The Dow Jones Industrial Average closed at 832.00

- The yield on the 30 year Treasury Bond was 10.35%

- $2.26 would buy 1 pound sterling

- The number 1 single was Pink Floyd's "Another Brick in the Wall"

- "60 Minutes" and "Three's Company" were doing battle for the number 1 TV show

January 7, 1980: President James Earl Carter signs the Chrysler Corporation Loan Guarantee Act of 1979, providing the company with $1.5 billion in backing. This enables the company to avoid bankruptcy.

Also:

- I was a just about a week past my 8th birthday

- The Dow Jones Industrial Average closed at 832.00

- The yield on the 30 year Treasury Bond was 10.35%

- $2.26 would buy 1 pound sterling

- The number 1 single was Pink Floyd's "Another Brick in the Wall"

- "60 Minutes" and "Three's Company" were doing battle for the number 1 TV show

This Is How Much Debt We Have

I have been wondering about this: how does this economy bounce back after deleveraging?

In a previous post, I shared my concerns about a Wall Street rebound. I fail to see where revenue will come from, absent debt issuance and loan securitization. The consumer became addicted to the debt drug, to the benefit of financial markets.

Exhibit 1.

Massive Increases Across All Borrowers

(Note: Only Federal Debt Held by the Public is Included. This is typical in most reporting lines. Inter-governmental holdings, Social Security Trust Fund holdings for example, are excluded. As if those bonds didn't have to be paid off too.)

Exhibit 2.

It's not like all of that borrowing lead to equally massive GDP growth. It takes an increasing amount of debt to keep the same standard of living.

Exhibit 3.

Lots of debt, not so many people. We can't afford to LOSE JOBS when so much is riding on so few shoulders.

In a previous post, I shared my concerns about a Wall Street rebound. I fail to see where revenue will come from, absent debt issuance and loan securitization. The consumer became addicted to the debt drug, to the benefit of financial markets.

Exhibit 1.

Massive Increases Across All Borrowers

(Note: Only Federal Debt Held by the Public is Included. This is typical in most reporting lines. Inter-governmental holdings, Social Security Trust Fund holdings for example, are excluded. As if those bonds didn't have to be paid off too.)

Exhibit 2.

It's not like all of that borrowing lead to equally massive GDP growth. It takes an increasing amount of debt to keep the same standard of living.

Exhibit 3.

Lots of debt, not so many people. We can't afford to LOSE JOBS when so much is riding on so few shoulders.

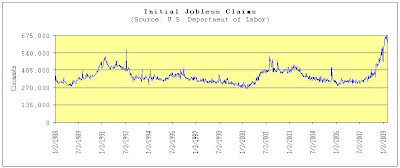

Jobless Claims

Initial claims moderated to 631,000 last week from an upwardly revised 645,000 the previous week. Continuing claims hit another record at 6,271,000: 4.7% insured unemployment rate.

You have to figure that an some point, initial claims will moderate. Each week, that 600,000+ number becomes a larger and larger percentage of the workforce. I would not feel much better about the economy until continuing claims show some sign of abatement.

By the way, equity futures are off of their overnight highs, but are still pointing to a good morning for longs: Dow futures are up over 100 points.

I'm Really Close to NEVER Trading Again

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=auJxnhL3YKQg

Repo Failure Remedy Drives Away Short-Sellers in Treasuries

It is impossible for me to describe how much disdain I have for this crew at the Fed. Clearly they have no idea of the consequences of their actions. Changing market rules that have long been in existence so they can ease the path for Treasury issuance only eliminates their credibility. They never see the forest through the trees.

Why would anyone participate in a market when the rules can change at any time? Remember that kid who couldn't stand to lose the ball game and would cheat or go home or change the rules? I do, that kid either got beat up or just got lonely playing by himself.

Repo Failure Remedy Drives Away Short-Sellers in Treasuries

It is impossible for me to describe how much disdain I have for this crew at the Fed. Clearly they have no idea of the consequences of their actions. Changing market rules that have long been in existence so they can ease the path for Treasury issuance only eliminates their credibility. They never see the forest through the trees.

Why would anyone participate in a market when the rules can change at any time? Remember that kid who couldn't stand to lose the ball game and would cheat or go home or change the rules? I do, that kid either got beat up or just got lonely playing by himself.

Wednesday, April 29, 2009

Four Reasons Why The Consumer Will Not Repeat Q1's Performance

The latest in the search for "green shoots" has focused on the consumer data in the GDP report and other economic releases. I urge caution because:

1. On April 1, 2009 there were 2.1 million fewer people working than on January 1, 2009.

2. Data for the last 2 IRS tax seasons indicates that 80.39% of tax refunds are processed in the first 3 months of the year. Obviously April is a big month as well, but that is it for the 2nd quarter's kicker.

3. According to the CPI Index, average prices were lower in the 1st quarter of 2009 than in the 4th quarter of 2008. Remember the discounting by struggling and folding retailers?

4. Consumers rushed to charge purchases before credit lines and home equity lines were pulled. Remember the stories about banks paying customers to close home equity lines? Also review the following: http://www.reuters.com/article/newsOne/idUSTRE4B01HI20081201

1. On April 1, 2009 there were 2.1 million fewer people working than on January 1, 2009.

2. Data for the last 2 IRS tax seasons indicates that 80.39% of tax refunds are processed in the first 3 months of the year. Obviously April is a big month as well, but that is it for the 2nd quarter's kicker.

3. According to the CPI Index, average prices were lower in the 1st quarter of 2009 than in the 4th quarter of 2008. Remember the discounting by struggling and folding retailers?

4. Consumers rushed to charge purchases before credit lines and home equity lines were pulled. Remember the stories about banks paying customers to close home equity lines? Also review the following: http://www.reuters.com/article/newsOne/idUSTRE4B01HI20081201

GDP Report and Equity Market Response

First quarter GDP retreated faster than expectations: 6.1% decrease

To review, the Bureau of Economic Analysis releases 3 GDP reports: Advance, Preliminary and Final. The report released today was the Advance report, so it could be subject to considerable revisions in following estimates.

In hindsight, an economy dropping 600,000 jobs a month can't be expected to turn on a dime. I also noticed that the investment component of the report continues to drop.

As for the market, I was quite wrong Monday. Buying then would have been a good idea.......but I guess that works if you sell soon. The Dow and the S&P 500 are moving higher by over 2%, what can the Fed say this afternoon to possibly justify this?

Oh yeah, just to compound my consternation: Bank of America & Citi need several billions of new capital according to several reports. Is the rumor about 16 banks tested for stress needing more capital on target? Of course, financial stocks are moving higher too.

Tuesday, April 28, 2009

Real Estate Market

The Case-Shiller home price indices were released today: 10 City Composite down 18.64% year over year, 20 City Composite down 18.63% year over year. The rate of decline slowed from the previous month's respective 19.43% and 19.00% drops. Could this signal a reversal? I don't know and I will not spend much time thinking about it.

What I do know is that home prices are the same level they were during the Summer of 2003. This is important because of the massive amount of mortgage debt in our economy. Housing has carry costs. The most prominent one is the mortgage interest rate. A homeowner also has to pay property taxes, electric bills, heating bills, water bills, sewer bills, repair bills, etc. These all add up to create the hurdle rate for owning property. If your home does not appreciate by more than the hurdle rate, you are losing money. I have mentioned this before: homes are depreciating assets. Therefore, this is a losing game. The best one should expect is to keep up with inflation.

So, even if home prices were flat for the last year or so, defaults would still be a major problem. Speculators needed to have markets going up, at least as much as the hurdle rate.

What this leaves us with is an upside-down nation. On average, the entire nation owns less of their homes than the mortgage holders do. This is crippling to disposable income and savings.

Increasing debt and falling prices have reduced the ability of homeowners to use the home equity ATM.

Lastly, the real estate inventory has much more wood to chop. There is still a large amount of vacant homes for sale, highlighting the point that net household creation should determine the housing supply (not cheap money).

Morning Notes

- Dow is poised to drop 90 points or so, based on futures trading

- Wall Street Journal reported last night that Citigroup and Bank of America are in need of additional capital

- Very busy data week continues: GDP and FOMC decision tomorrow, unemployment claims and ECI on Thursday and ISM on Friday

Monday, April 27, 2009

S & P 500 Earnings: What Are Equities Worth?

In theory, a company's stock should reflect its ability to generate future earnings. Traditionally, equity models would compute dividend pay-out rates based on how quickly those future earnings were expected to grow. In short, the better the earnings prospects, the more you should pay for a company's shares.

In the 4th quarter, the S&P 500 posted its first quarterly loss in history. Think about that, the entire index (on average) lost money.

- The above graph tracks the 12-month trailing earnings on the S&P 500. Currently, the index is trading at 865.30 (down a bit today). Trailing 12-month earnings total $14.88: price/earnings ratio of 58.15

- Some may say "Look at the future smart guy !" OK, I will.

S&P is forecasting the following 12-month trailing earnings:

12/31/09___________$28.51

03/31/10___________$30.83

06/30/10___________$33.49

09/30/10___________$34.59

12/31/10___________$35.31

I didn't bother to post the earlier 2009 numbers because they drop for 3/31/09 AND ARE NEGATIVE FOR 9/30/09.

So, jumping to 2010 we find an average $33.56 earnings number. The forward P/E is 25.79:

- Another way to look at this: the forward earnings yield is 3.88%. Both on a trailing and expectations level, this number has historically been closer to 4.84%

- Index level = $33.56 / 4.84% = 693.29

I would not buy stocks today.

In the 4th quarter, the S&P 500 posted its first quarterly loss in history. Think about that, the entire index (on average) lost money.

- The above graph tracks the 12-month trailing earnings on the S&P 500. Currently, the index is trading at 865.30 (down a bit today). Trailing 12-month earnings total $14.88: price/earnings ratio of 58.15

- Some may say "Look at the future smart guy !" OK, I will.

S&P is forecasting the following 12-month trailing earnings:

12/31/09___________$28.51

03/31/10___________$30.83

06/30/10___________$33.49

09/30/10___________$34.59

12/31/10___________$35.31

I didn't bother to post the earlier 2009 numbers because they drop for 3/31/09 AND ARE NEGATIVE FOR 9/30/09.

So, jumping to 2010 we find an average $33.56 earnings number. The forward P/E is 25.79:

- Another way to look at this: the forward earnings yield is 3.88%. Both on a trailing and expectations level, this number has historically been closer to 4.84%

- Index level = $33.56 / 4.84% = 693.29

I would not buy stocks today.

Who Pays For The TARP?

We do mostly. The graph below tracks the revenue side of the Federal Government's income statement. Of course, this revenue stream is less than the torrent of money flowing out. Therefore, Treasury issuance will insure that our offspring will come to know this fine equation as well. We are also privileged to pay a good portion of social insurance taxes (Medicaid, Medicare, Social Security) too. Please click on the graph to expand.

Equity Futures Down Considerably.....

..but no mention of this on the Bloomberg News website. Since last night, Dow futures have been trading off by over 100 points (down about 136 now). There is a large difference between its current level and fair value, I think this warrants a headline.

Saturday, April 25, 2009

Credit Union Joins Failure Friday

The National Credit Union Administration placed Eastern Financial Florida Credit Union into conservatorship yesterday. The NCUA's press release does not provide much in the way of details, but the credit union held $1.6 billion in assets at the time of its seizure.

Friday, April 24, 2009

The No-Stress Tests

All of you know that the death knell for the financial sector has been ringing in my head for quite a long time. I will cut to the chase: the Fed, OCC, OTS, FDIC and Treasury Department have done a splendid job by reassuring the patient with heart disease they are in great shape since their heart rate while sitting down and watching the fish bowl is right in line. The test instructs banks to consider a baseline scenario and a more adverse scenario when valuing their portfolios.

Real GDP

-2% & -3.3% for 2009

2.1% & 0.5% for 2010

The last reading for annualized real GDP growth was -6.34% and the average growth rate since the start of the recession is -0.71%. This represents a small correction considering the employment loss that has been experienced in the same time frame. My guess is that corporations delayed inventory corrections, thinking that the slowdown would pass.

Declines of 2% and 3.3% in real GDP for all of 2009 bring the economy back to where it was in the 2nd quarter 2006 (almost to the penny) and late 2005 / early 2006 respectively. I have mentioned in previous posts that the U.S. would need to dial back to 2005 levels to begin clearing the decks for a recovery. This would represent a drop of 4.6% from 4th quarter, 2008 GDP. Therefore, at the very least, the more adverse scenario should be a number less than -4%.

Real GDP

-2% & -3.3% for 2009

2.1% & 0.5% for 2010

The last reading for annualized real GDP growth was -6.34% and the average growth rate since the start of the recession is -0.71%. This represents a small correction considering the employment loss that has been experienced in the same time frame. My guess is that corporations delayed inventory corrections, thinking that the slowdown would pass.

Declines of 2% and 3.3% in real GDP for all of 2009 bring the economy back to where it was in the 2nd quarter 2006 (almost to the penny) and late 2005 / early 2006 respectively. I have mentioned in previous posts that the U.S. would need to dial back to 2005 levels to begin clearing the decks for a recovery. This would represent a drop of 4.6% from 4th quarter, 2008 GDP. Therefore, at the very least, the more adverse scenario should be a number less than -4%.

Recoveries are notoriously hard to predict, 2010 is a long way off in some respects. The U.S. has a history of bouncing back quickly after economic slowdowns. Given a correction back of 2005 levels, I would consider the more adverse scenario of 0.5% acceptable. Breaking 2% will be difficult in my opinion. I just don't see what industry will snap America back (and maybe that is why America does recover so quickly!).

Civilian Unemployment Rate

8.4% & 8.9% for 2009

8.8% & 10.3% for 2010

This number has been steadily increasing (8.5% was the most recent print) and 8.9% seems easily surpassable. The average for the 1st quarter of 2009 is 8.1%. Unless something radically changes, I think we will hit 9% by June and the rest of the year will pull the average unemployment rate to 9.1%. Remember, this is supposed to be a "stress" test. It is not supposed to be a "what could certainly happen, within the realm of possibility" test. In 2007, few people thought the events of 2008 would have transpired.

Once again, the more adverse scenario for 2010 seems acceptable. Once again, a baseline of 8.8% is assuming the typical U.S. recovery.

House Prices

-14% & -22% for 2009

-4% and -7% for 2010

This is a tricky one. The benchmark chosen for this input is the Case Shiller 10 City Composite. The index print from 12/08 was 162.12 and the percentage declines for 2009 are based off of that number. Price declines have been accelerating, dropping at a 19.4% year over year rate (January, 2009 report). A drop of 14% from the 12/08 print would bring home prices back to 2002 levels. This seems reasonable to me, as does the more adverse case. The 2010 levels seem appropriate as well. However, this is highly sensitive to the employment picture. On average, the entire country is upside-down on their mortgages. This leaves little margin for error on the side of public policy.

http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20090424a1.pdf

Civilian Unemployment Rate

8.4% & 8.9% for 2009

8.8% & 10.3% for 2010

This number has been steadily increasing (8.5% was the most recent print) and 8.9% seems easily surpassable. The average for the 1st quarter of 2009 is 8.1%. Unless something radically changes, I think we will hit 9% by June and the rest of the year will pull the average unemployment rate to 9.1%. Remember, this is supposed to be a "stress" test. It is not supposed to be a "what could certainly happen, within the realm of possibility" test. In 2007, few people thought the events of 2008 would have transpired.

Once again, the more adverse scenario for 2010 seems acceptable. Once again, a baseline of 8.8% is assuming the typical U.S. recovery.

House Prices

-14% & -22% for 2009

-4% and -7% for 2010

This is a tricky one. The benchmark chosen for this input is the Case Shiller 10 City Composite. The index print from 12/08 was 162.12 and the percentage declines for 2009 are based off of that number. Price declines have been accelerating, dropping at a 19.4% year over year rate (January, 2009 report). A drop of 14% from the 12/08 print would bring home prices back to 2002 levels. This seems reasonable to me, as does the more adverse case. The 2010 levels seem appropriate as well. However, this is highly sensitive to the employment picture. On average, the entire country is upside-down on their mortgages. This leaves little margin for error on the side of public policy.

http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20090424a1.pdf

Historical Jobs Data

It is interesting to note the relative performance of the jobs market over the last 70 years. Growth in jobs seems to have peaked and is now experiencing a downward trend.

Change in non-farm payrolls from beginning to end of recessions:

| Start | End | Change |

| Nov-73 | Mar-75 | -1.62% |

| Jan-80 | Jul-80 | -1.07% |

| Jul-81 | Nov-82 | -3.08% |

| Jul-90 | Mar-91 | -1.13% |

| Mar-01 | Nov-01 | -1.21% |

| Dec-07 | ? | -3.72% |

Durable Goods

Durable goods came in a bit better than the consensus forecast. Of course, the market grabs this one month blip and claims it knows the bottom. i will say the following:

- January's print was revised lower, the first monthly reading below $160 billion since August of 1996

- February's print was also revised lower

- Today's print was 25% lower than March of last year

On another note, I started working on my forecast of the jobs report due the first week of May. I believe that we will see another drop over 600k. It is said that the jobs data is a lagging indicator. I'll take that, but should you really feel good about the economy if the payroll number is less than zero?

Thursday, April 23, 2009

Been Writing About This One For A While

http://www.bloomberg.com/apps/news?pid=20601087&sid=acCuQWHhszjE

Commercial Mortgage Crunch

Since February I have been warning about issues with commercial mortgages. This problem will wreck regional banks and will shake Bank of America to its core.

Commercial Mortgage Crunch

Since February I have been warning about issues with commercial mortgages. This problem will wreck regional banks and will shake Bank of America to its core.

Existing Home Sales

Remember this one? Last month's print was given credit for the continuation of the equity market rally. The headline number came in at 4.57 million, down from last month's 4.71 million. This is an annualized, seasonally adjusted number of existing homes sold in the U.S.

The below graphs track the inventory and average prices for the existing home market. It looks to me like the market is stabilizing: buyers and sellers are coming to grips with the new market realities. However, I would not call this the bottom, bottom. Foreclosure moratoriums are continuing to expire and and the employment situation is not improving.

The below graphs track the inventory and average prices for the existing home market. It looks to me like the market is stabilizing: buyers and sellers are coming to grips with the new market realities. However, I would not call this the bottom, bottom. Foreclosure moratoriums are continuing to expire and and the employment situation is not improving.

Weekly Jobless Claims: Little Sign of a Bottom

Not much in the way of green shoots here. Initial claims seem to have found a home in the 620,000 to 640,000 range. Today's report: initial claims of 640,000, continuing claims of 6,137,000 and an IUR of 4.6%.

Continuing claims and the IUR are data series highs, I can't imagine where the money to pay for jobless benefits going forward will come from. Tax receipts on all municipal levels are falling and tax rebates are climbing. I guess the federal government will have to subsidize the bill. More Treasury issuance anyone?

Wednesday, April 22, 2009

You Own This Mess Too !

You Own 'Em America!

I am working on an expanded post about Fannie, Freddie and the Fed Home Loan Banks (little cousin of the GSE family, but just as poorly managed). I just wanted to share a few things because I forgot how ridiculous this whole situation is:

- Fannie & Freddie lost a combined $108.4 billion in 2008

- Total combined obligations total $6.2 trillion

- The U.S. Government owns roughly 80% of Fannie & 80% of Freddie

This effectively increases the national debt by roughly by 55%:

Debt of the General Fund: $11.2 trillion

GSEs: $6.2 trillion

Total: $17.4 trillion

That is $2.7 trillion more than last year's GDP.

What Goes Up......

Morgan Stanley's earnings were a bit of a disappointment to the market. Part of the issue was that they had to take a hit to their revenue because their credit spreads improved. Yep, the reverse is true too. John Mack made specific mention of that fact; Morgan Stanley would have made a profit otherwise. Funny, they never mention it when it works in their favor.

MS is down about $2.00 in the pre market session and S & P futures are down abut 1%.

Tuesday, April 21, 2009

Back To CDS

Yep, back to these graphs again. The bank rally on the back of yesterday's slide was accompanied by MORE NEW LOWS in bank asset pricing. Please note: the CMBX tranches are now priced using the same convention as the ABX tranches. The data provider made the switch yesterday.

So, once again, bank stocks moved higher and the perceived quality of their assets dropped. To review, these credit default swaps are based on indices of asset backed securities. The ABX indices track residential mortgage assets and the CMBX tracks commercial mortgage assets.

Although similar to bonds and other fixed income products in some respects, these mortgage assets are not guaranteed (nor even expected) to pay off the full face amount. This is true for even Fannie, Freddie and Ginnie mortgage backed securities. The cash flows from the loans themselves are used to make the principal and interest payments on the securities. The main reason why, even in normal conditions, $100 in principal would not be expected to be paid back is prepayments. Of course, there is also some baseline default activity as well.

Therefore, I would not expect to see the lower rated tranches move off their lows. There is no "pull to par." The problem is the higher rated indices, particularly the residential side. This is important to note, especially since Fannie & Freddie reported today that prime mortgages were defaulting a substantial rate. There is no safe haven. Those 600,000 jobs a month that the economy is losing devastating all types of borrowers.

I urge you to use extreme caution on either side of the bank stock trade. Fundamentally, I see no reason to establish a long position in any bank. Shorting can be hazardous because the SEC can change short selling rules whenever they want to. Stay true to your targets.

Global Deflation, Global Depression?

On 4/15/09, I wrote a couple of posts about real interest rates and deflation. The warning bells are going off in this country: the longer the deflation trend continues, the more likely it is that we wind up in a depression.

The rest of he world is getting those signals as well:

British economy falls into deflation for first time since 1960

http://www.telegraph.co.uk/finance/financetopics/recession/5192521/British-economy-falls-into-deflation-for-first-time-since-1960.html

Spain's Falling Prices Fuel Deflation Fears in Europe

http://www.nytimes.com/2009/04/21/business/global/21deflate.html?ref=global-home

Price falls fuel Japan deflation fears

http://www.ft.com/cms/s/0/feab77dc-288a-11de-8dbf-00144feabdc0.html

The rest of he world is getting those signals as well:

British economy falls into deflation for first time since 1960

http://www.telegraph.co.uk/finance/financetopics/recession/5192521/British-economy-falls-into-deflation-for-first-time-since-1960.html

Spain's Falling Prices Fuel Deflation Fears in Europe

http://www.nytimes.com/2009/04/21/business/global/21deflate.html?ref=global-home

Price falls fuel Japan deflation fears

http://www.ft.com/cms/s/0/feab77dc-288a-11de-8dbf-00144feabdc0.html

Monday, April 20, 2009

Umm.....What ?!??!?!

http://www.nytimes.com/2009/04/19/business/economy/19view.html?_r=1

I post this because it is quite relevant to my post regarding real interest rates. Beyond that, no comment.

I post this because it is quite relevant to my post regarding real interest rates. Beyond that, no comment.

How Would The Capital Conversion Work?

Please click on the table to expand. Most readers will recognize this TARP recap. The TARP investments have been in the form of preferred stock. The NYT article I referred to earlier today puts forth the scenario of converting the preferred stake to common shares.

If this is the way the Treasury Department decides to go, common equity holders will be diluted into non-existence. I guess the Treasury could take losses to ease the dilution, but I don't like that idea.

Wall Street Journal Catches On

http://online.wsj.com/article/SB124019360346233883.html#mod=djemalertNEWS

"Bank Lending Keeps Dropping"

Mainstream press: day late, dollar short

BAC Earnings

Since when did the protocol become announcing net income BEFORE preferred dividends? For as long as I can remember, companies reported earnings per share after deducting dividends paid to preferred shareholders.

Bank of America reported net income of $4.2 billion, a supposedly stellar figure. However, earnings per common share came out to only $0.44. Take 44 cents times the shares outstanding and you get $2.8 billion. THIS IS THE ACTUAL NUMBER PEOPLE !!!!!!!!!!!!

The company paid over $1.4 billion in preferred dividends in the first quarter alone. Ponderous.

They also booked $1.9 billion in pre-tax gains from their sale of shares in China Construction Bank. They realized $2.2 billion in income from their credit spreads widening.

Overall revenue numbers jumped because the company is considerably larger after the Merrill & Countrywide acquisitions. Of course, you have to pay for all of these new toys: non-interest expense increased 55% from the previous quarter.

I am not impressed.

http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=irol-newsArticle&ID=1277955&highlight=

Bank of America reported net income of $4.2 billion, a supposedly stellar figure. However, earnings per common share came out to only $0.44. Take 44 cents times the shares outstanding and you get $2.8 billion. THIS IS THE ACTUAL NUMBER PEOPLE !!!!!!!!!!!!

The company paid over $1.4 billion in preferred dividends in the first quarter alone. Ponderous.

They also booked $1.9 billion in pre-tax gains from their sale of shares in China Construction Bank. They realized $2.2 billion in income from their credit spreads widening.

Overall revenue numbers jumped because the company is considerably larger after the Merrill & Countrywide acquisitions. Of course, you have to pay for all of these new toys: non-interest expense increased 55% from the previous quarter.

I am not impressed.

http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=irol-newsArticle&ID=1277955&highlight=

A Step Towards Nationalization?

http://www.nytimes.com/2009/04/20/business/20bailout.html?hp

The above link will take you to a New York Times article discussing the possibility of the Treasury Department converting its preferred stake to common equity. For some reason, the author refers to this money as currently being a "loan." This is not my understanding and I do not know why he states this. Regardless of the intentioned holding period, a preferred stock investment is not a loan.

This article just happens to appear as the we near the deadline for the stress test results, Bank of America's earnings release (today) and my May guesstimate of a large bank being nationalized.

Equity futures are down, could be an interesting day.

Sunday, April 19, 2009

What Is The Fed Up To? (Part II): Assets

The above graph tracks the outright holdings of the Fed, please click to expand. Outright holdings refer to the securities that the Fed has purchased outside of repurchase (liquidity) transactions.

On 11/25/08 , The Fed announced that they would purchase outright mortgage backed securities issued by Freddie Mac, Fannie Mae and Ginnie Mae. The actual purchases were to start in January and continue through 2009. On March 18, the Fed announced that it intended to purchase up to $1.25 trillion of these securities.

The first thing that hits me is the fact that they announced their intentions over a month before they came into the market to buy. This provided plenty of lead time for dealers to bid the price of the securities higher, knowing that they had a buyer locked in. Any wonder why fixed income trading revenue was so sky-high for all of the banks that have reported earnings so far?

It is clear that the Fed has no intention of fixing the problem of over-leverage. The debt is just being consolidated on the books of the Fed. The truth is, these are not the riskiest assets to hold (they have enough exposure to those in the Maiden Lane LLCs). Ginnie Mae is explicitly backed by the Federal government. Fannie's & Freddie's backing is not as strong, but the government has made it clear that they are willing to pledge the taxpayer's dollar if need be. So, on a credit risk basis, these securities are not that different from Treasury debt.

The problem boils down to the following: if there is debt outstanding, someone has to pay for the principal and interest payments. If there are defaults on this paper, you and I pay for it. Meanwhile, the parties who should have been left holding the bag, get off the hook. The debt should pay nothing and the buyers should take the loss. This business of printing money to bail out profit making institutions must stop.

A Little Bit More On Banks Not Lending

What Is The Fed Up To?

From the Federal Reserve statistical release H.4.1 (4/16/09):

- Leverage

- The Federal Reserve System holds $47.84 in assets for each dollar of capital

- Securities Holdings

- Holdings of U.S. Treasury Debt have decreased by $22.5 billion in 1 year

- Holdings of GSE debt have increased by $61.4 billion in 1 year

- Holdings of GSE /Agency MBS have increased by $355.6 billion in year

- Liquidity Programs

- Term Auction Credit totaled $455.8 billion

- Commercial Paper Funding Facility totaled $238.4 billion

- Other Loans totaled $111.2 billion (of which $45.1 billion is their loan to AIG)

- Non Recourse, Secured Loans

- Maiden Lane LLC: $26.4 billion

- Maiden Lane LLC II: $18.2 billion

- Maiden Lane LLC III: $27.4 billion

On the liability front: deposits from depository institutions (The Fed’s liability) totaled $894.9 billion, an $882.2 billion increase from a year ago.

Banks really have nothing better to do with their funds than to leave them on deposit with the Fed? This is why the economy will NOT turn around. There is no money expansion. The duo of the Fed & Treasury Department simply can't put enough money in the system to counteract the credit contraction being orchestrated by the banks. I will address the asset side of the balance sheet in another post.

Bank Failures 2009: Update

In 2009:

- 25 banks have been shut down by the FDIC

- The FDIC estimates their loss on these closings at $3.16 billion

- On average, the estimated losses come to 25.3% of the total assets of the closed institutions

In the next week or so, expect some more news about BankUnited, FSB. The Office of Thrift Supervision gave them an ultimatum this week: fix the capital adequacy problem or else. See link below:

http://files.ots.treas.gov/enforcement/97100.pdf

Friday, April 17, 2009

Citigroup Earnings: First Glance

4 items caught my eye, will look into this when the 10-Q is released:

- looks like they booked $2.5 billion in revenue from the old Lehman trick of marking their own debt

- income from selling Redecard, looks like a net gain of $704 million

- FAS 115 change leads to higher retained earnings

- FAS 115 change leads to lower impairment charges

- looks like they booked $2.5 billion in revenue from the old Lehman trick of marking their own debt

- income from selling Redecard, looks like a net gain of $704 million

- FAS 115 change leads to higher retained earnings

- FAS 115 change leads to lower impairment charges

Thursday, April 16, 2009

Waiting For The 10-Q: JPM

No 10-Q yet on the SEC website. It is clear from the 8-K though that the fixed income division was the one with the greatest outperformance. Fixed income markets accounted for about 20% of the entire firm's revenue. In terms of earnings, the investment bank was the only line of business that posted an improvement from last quarter.

I will report back when after reviewing the 10-Q.

Foreclosure Update

I know that I am probably the last one to write a post on this, but I have been trying (unsuccessfully) to reconcile some data in the RealtyTrac report. A few things from the month to month reports do not tie out with their quarterly figures. Anyway, the numbers are still grim: well over 300,000 new foreclosure notice in March. What I find astonishing is the rate of home foreclosures in certain states for the first quarter of this year.

- Florida 1 in every 73 homes received a notice

- California 1 in every 58

- Arizona 1 in every 54

- Nevada 1 IN EVERY 27

- Florida 1 in every 73 homes received a notice

- California 1 in every 58

- Arizona 1 in every 54

- Nevada 1 IN EVERY 27

Wednesday, April 15, 2009

All We Need to Know: Real Interest Rates

The Fisher Equation:

nominal interest rate = inflation rate + real interest rate + (real interest rate * inflation rate)

The last term is typically small and ignored when casually calculating the real interest rate. So:

real interest rate = nominal interest rate - inflation rate

This is important because the net impact of borrowing can only be calculated with this rate. For example, a consumer borrows $100 for 1 year at 6% simple interest. With the $100, the consumer buys a year's worth of groceries. In one year, the consumer needs to pay back a total of $106.

Let's say that over that year, prices were steadily increasing. If the consumer bought groceries over the course of the year, the average price would have been $110. The consumer benefited from borrowing and locking in prices at the beginning of the period.

In equation form: -4% = 6% - 10%

With regard to businesses, they will borrow money to produce goods if they can sell those goods at higher prices in the future. There is a production lag, of course. Goods that are being manufactured today usually aren't sold today.

Companies need more pricing power when interest rates are higher. As we know, corporate credit is terribly expensive. Today's CPI release shows us that they do not have the requisite pricing power to borrow at current rates. This is the danger of deflation. Why would a consumer borrow money to lock in prices if prices are going to fall? Why would a business borrow money to produce goods that will drop in price? No demand for debt........

Yet, real interest rates are not low by recent historical standards. The graph below tracks a bank lending rate (nominal proxy) versus an inflation rate (CPI). The government if failing miserably at creating an environment that will promote growth. THEY NEED TO STOP BEFORE THEY INSURE A DEPRESSION FOLLOWS. Let the savings rate rebound and suffer the pain of inventory and consumption correction. Issuing debt is only increasing real interest rates and cutting the recovery off at its knees.

Is a Depression Upon Us?

The BLS released the monthly CPI report today: 0.1% drop from February.

This brings the year over year drop to 0.4%, the largest annual decrease since 1955. The above graph goes back to the early 1970s and it is easy to pick out the recent trend. Although PPI has, from time to time, breached the zero barrier, CPI has not. Deflation is upon us.

Going back to Irving Fisher's piece, "The Debt-Deflation Theory of Great Depressions", the pairing of overindebtedness and deflation leads to depressions. I think the case for too much debt is clear:

- Federal debt to GDP ratio is at a generational high

- Homeowners now face negative equity

- Corporate borrowing spreads at multi-year highs

Fisher came to the conclusion that, if acted upon soon enough, the government can reflate the economy. I do not believe that this is the case today. He may have been writing with a different monetary/banking system frame of reference, the Fed was still brand new at the time. But as I have mentioned, debt is money in our world. The paradox will prohibit reflation from happening. We are staring into the abyss.

Link to Fisher paper:

http://fraser.stlouisfed.org/docs/meltzer/fisdeb33.pdf

Tuesday, April 14, 2009

China Has Fewer USD to Spend As Well

In a post last week I mentioned the deteriorating current account surplus of Japan and its impact on our national debt. Consider the following:

China Slows Purchases of U.S. and Other Bonds

http://www.nytimes.com/2009/04/13/business/global/13yuan.html?_r=1&ref=business

I tried to find the data myself, but the People's Bank of China website is terrible. Suffice it to say, with fewer buyers of Treasury debt, something has to give.

China Slows Purchases of U.S. and Other Bonds

http://www.nytimes.com/2009/04/13/business/global/13yuan.html?_r=1&ref=business

I tried to find the data myself, but the People's Bank of China website is terrible. Suffice it to say, with fewer buyers of Treasury debt, something has to give.

A Closer Look at Goldman Sachs' Earnings

As you know, The Goldman Sachs Group, Incorporated became a bank holding company last year. As such, they became eligible to participate in the government rescue programs. They expanded their bank operation so they could foist the bulk of their assets on the back of the FDIC. Check the FDIC website, the assets of Goldman Sachs Bank USA have grown from $19.1 billion to $162.5 billion in just one year. Funding with deposits is much cheaper than funding with corporate debt.

Anyway, as a bank holding company, they are required to report earnings on a calendar year basis. They had formerly reported using a November fiscal year end. Their most recent annual report includes financials up to NOVEMBER 30, 2008.

Last night's release included the earnings for January, February and March of this year. Goldman reported earnings of $3.39 per share, easily besting estimates of $1.64 per share.

You may ask, what happened to December? It was not included in the previous quarter's release, nor in this release. Well, December appears at the end of the press release in its own little category.

What happened in December? I'm glad you asked. Goldman recorded a LOSS OF $2.15 per share. Add it together, and you come up with earnings of $1.24 for the four month total. I am not sure about how Wall Street analysts accounted for this, but it adds up to an earnings miss to me.

I have attached the link below, please double check my understanding of the data. I would hate to bad mouth Goldman.

http://www2.goldmansachs.com/our-firm/press/press-releases/current/pdfs/2009-q1-earnings.pdf

Anyway, as a bank holding company, they are required to report earnings on a calendar year basis. They had formerly reported using a November fiscal year end. Their most recent annual report includes financials up to NOVEMBER 30, 2008.

Last night's release included the earnings for January, February and March of this year. Goldman reported earnings of $3.39 per share, easily besting estimates of $1.64 per share.

You may ask, what happened to December? It was not included in the previous quarter's release, nor in this release. Well, December appears at the end of the press release in its own little category.

What happened in December? I'm glad you asked. Goldman recorded a LOSS OF $2.15 per share. Add it together, and you come up with earnings of $1.24 for the four month total. I am not sure about how Wall Street analysts accounted for this, but it adds up to an earnings miss to me.

I have attached the link below, please double check my understanding of the data. I would hate to bad mouth Goldman.

http://www2.goldmansachs.com/our-firm/press/press-releases/current/pdfs/2009-q1-earnings.pdf

Looking at CDS.....Again

This may be getting a bit boring, but I want this point driven home: asset prices are not recovering. Bank stocks are moving higher (we'll get to that in another post), but it is not because the market perceives asset quality to be improving.

Two tranches closed at record lows today. Every tranche is trading within 9.2% of its lowest closing level. I really don't expect the BBB- CDS to move much, but the single A and higher tranches are not budging either.

Twenty-eight CMBX tranches closed at new highs today. The only ones trading markedly off their highs are the AAA tranches. Not coincidentally, these tranches represent the types of securities eligible for purchase by the asset purchase programs.

Please review the posts from 11/18/08, 2/24/09, 3/28/09 and 4/8/09 for more details.

Two tranches closed at record lows today. Every tranche is trading within 9.2% of its lowest closing level. I really don't expect the BBB- CDS to move much, but the single A and higher tranches are not budging either.

Twenty-eight CMBX tranches closed at new highs today. The only ones trading markedly off their highs are the AAA tranches. Not coincidentally, these tranches represent the types of securities eligible for purchase by the asset purchase programs.

Please review the posts from 11/18/08, 2/24/09, 3/28/09 and 4/8/09 for more details.

Retail Sales

The Census Bureau released its monthly retail sales report today: 1.2% drop from February.

Obviously, the consumer is sitting this "recovery" out. All of the work the Administration is doing to promote consumption is for naught. It is the wrong premise anyway, rebuilding savings is the way to go. As painful as it will be, it is the only fix.

Full year 2008 retail sales actually decreased from the full year of 2007 and the slowdown shows no signs of letting up. Retail sales for the 1st quarter of 2008 totaled $1.14 trillion. For the 1st quarter of this year, the total is $1.04 trillion. This is a drop of about 8.75%, a number that prompted retail stocks to sell off substantially today.

Obviously, the consumer is sitting this "recovery" out. All of the work the Administration is doing to promote consumption is for naught. It is the wrong premise anyway, rebuilding savings is the way to go. As painful as it will be, it is the only fix.

Full year 2008 retail sales actually decreased from the full year of 2007 and the slowdown shows no signs of letting up. Retail sales for the 1st quarter of 2008 totaled $1.14 trillion. For the 1st quarter of this year, the total is $1.04 trillion. This is a drop of about 8.75%, a number that prompted retail stocks to sell off substantially today.

Thursday, April 9, 2009

Banner Day for Financial Stocks

- Can we trust the government to be objective when they are the major shareholders in banks?

- How "stressful" were the stress tests?

- How much will the modified accounting rules add to earnings?

- Is writing up asset valuations really prudent when continuing unemployment claims are just about 6 million?

- Do you think that most of the banks' operating earnings resulted from the MBS land grab?

I got what I wanted, an unwarranted rally in bank stocks. Prepare to short the sector en masse. Watch out for SEC rule changes on the way. The government is out of bullets.

- How "stressful" were the stress tests?

- How much will the modified accounting rules add to earnings?

- Is writing up asset valuations really prudent when continuing unemployment claims are just about 6 million?

- Do you think that most of the banks' operating earnings resulted from the MBS land grab?

I got what I wanted, an unwarranted rally in bank stocks. Prepare to short the sector en masse. Watch out for SEC rule changes on the way. The government is out of bullets.

Wednesday, April 8, 2009

Pension Benefit Guaranty Corporation (PBGC)

With the discussions of a GM bankruptcy heating up, the press has turned to an examination of the GM pension plan. According to a Bloomberg article, the PBGC would be on the hook for about $4 billion of the $20 billion plan short-fall. GM workers would take a $16 billion hit.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aazS4bEfFmzs

So I took a look at the books of the PBGC. Amazingly, they are ALREADY operating at a deficit. As of 9/2008, the PBGC has a negative net worth of $11.15 billion. They have a $100 million credit line with the Treasury. Any material borrowing to cover deficits will be on the back of the taxpayer via debt issuance. Sound familiar? FDIC, NCUA and PBGC: the taxpayer covers for corporate malfeasance and regulatory incompetence.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aazS4bEfFmzs

So I took a look at the books of the PBGC. Amazingly, they are ALREADY operating at a deficit. As of 9/2008, the PBGC has a negative net worth of $11.15 billion. They have a $100 million credit line with the Treasury. Any material borrowing to cover deficits will be on the back of the taxpayer via debt issuance. Sound familiar? FDIC, NCUA and PBGC: the taxpayer covers for corporate malfeasance and regulatory incompetence.

ASSET-BACKED CDS TRADES AT NEW ALL TIME EXTREMES

How is this for an unambiguous snapshot of the asset backed market:

- 28 of the 34 CMBX tranches closed at new all time highs today

- 12 of the 24 ABX tranches closed at new all time lows today

NOBODY WANTS TO OWN THIS PAPER !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Please check posts of 11/18/08, 2/24/09 and 3/28/09 for details about the CDS markets.

Merger in the Home Industry

Pulte Homes to Buy Centex for $1.3 Billion in Survival Bid

http://www.bloomberg.com/apps/news?pid=20601087&sid=acFiZhbx1OZM&refer=home

This is the first real sign of a bottom that I have seen. I know, it is a relatively small trade because Centex stock is down 70%. But two companies were able to agree on a future valuation for home building. They could be right, they could be wrong. What is important is that the process has begun.

Forget all of the other false positives, here is your green shoot.

http://www.bloomberg.com/apps/news?pid=20601087&sid=acFiZhbx1OZM&refer=home

This is the first real sign of a bottom that I have seen. I know, it is a relatively small trade because Centex stock is down 70%. But two companies were able to agree on a future valuation for home building. They could be right, they could be wrong. What is important is that the process has begun.

Forget all of the other false positives, here is your green shoot.

New Data From Japan: Who Will Buy U.S. Debt?

The current account is the sum of the balance of payments, financing activity and financial transfers for a nation. For a nation like Japan:

- Exporting nation, balance of payments positive

- Net creditor, financing positive

- Established nation, transfers negative

Net, Japan typically reports a monthly positive current account. That means that they have to figure out what to do with the foreign currencies they receive. The U.S. has been a major importer of Japanese goods, so they usually have a large supply of USD on hand. If Japan always sells those USD and buys JPY, they would erode their competitive advantage. They want a cheap JPY, so they keep the funds in USD and buy U.S. Treasuries.

This has provided the U.S. with a stable demand for debt. There are two major problems though: Economic slowdown and the emergence of China.

China has now eclipsed the U.S. as Japan's top trading partner. It is a sign that our political clout will wane and shows how much we are falling on a relative trade basis. Our nation is in a DEPRESSION and China is growing (albeit at a slower rate than the last five years).

The U.S. imports from China, meaning that they have a large supply if USD as well. However, our economy is slowing so much, that the growth rate of their USD position is falling as well.

U.S. Treasuries have been in the news because of the large supply being issued to fund all of the new government initiatives. Some say you should sell Treasuries because inflation is just around the corner. In theory, I agree. The timing is uncertain though. What I do know is that funds available to buy these bonds are drying up and the perception around the world about the soundness of our economy is changing. Get ready to short Treasuries because of that.

China Becomes Japan's Largest Trading Partner

http://www.thetrumpet.com/?q=5446.3771.0.0

Japan Exports Fall to Record Low

http://edition.cnn.com/2009/BUSINESS/03/25/japan.exports/

Export Slump Hits Japan's Current Account

http://www.google.com/hostednews/afp/article/ALeqM5htd2R1bv6caNjG3QVfdGBZU_pIsQ

If You Keep Changing the Rules, Are They Really Rules?

http://www.cnbc.com/id/30083434

SEC is considering ways to limit short selling.

Treasury Department delays stress test results to avoid complicating earnings season.

Come on already, we have seen this before and it does not work.

Tuesday, April 7, 2009

Primary Dealer Holdings ReDux

Please refer to the 2/11/09 post for details about dealer hedging procedures.

Wow, primary dealers are now outright long Treasury securities. No interest rate hedging for these guys, they have perfect information about the future I guess. Let's examine the changing risk appetite over the last nine months:

Corporate Holdings (>1 year): -54.82%

Mortgage Backed Holdings: -14.49%

GSE Debt (>1 year): -35.77%

Treasuries: went from a short position of $69 billion to a long position of $20 billion

The takeaway: dealers are trading credit risk for interest rate risk.

Subscribe to:

Posts (Atom)