Friday, November 28, 2008

The FDIC Keeps Getting Thinner and Thinner

The Temporary Liquidity Guarantee Program (TLGP) is the FDIC's foray into backing corporate debt. It was announced about a month ago, but it was utilized extensively this week:

JP Morgan Chase: $6.5 billion in debt issued, AAA rated based on FDIC backing

Morgan Stanley: $5.75 billion in debt issued, AAA rated based on FDIC backing

Goldman Sachs: $5.0 billion in debt issued, AAA rated based on FDIC backing

In an earlier post this week, I mentioned that the Deposit Insurance Fund's reserve ratio dropped to 0.76% at the end of the 3rd quarter. So, (all else being equal) if the FDIC had to pay off the above referenced bonds, the fund would be cut in HALF.

Wednesday, November 26, 2008

Economic Reports: We're Not Out Yet

Examples of durable goods are automobiles, household appliances and home furnishings; goods with an expected life of 3 years or so. This is a glimpse into the follow on effects of the housing crunch. Not only will there be lower demand for durable goods because of fewer housing transactions, but the elimination of the home equity "ATM" will have a dampening effect on the normal renewal cycle. This is the first time since 2005 that this number has come in below $200 billion and the lowest since April of that year.

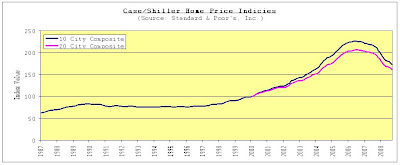

New home sales dropped to an annualized rate of 433,000. At that rate, it would take a little over 5 YEARS to eliminate the number of vacant housing units. That is assuming that there is no addition to the housing supply over that time span. This is the result of the rampant real estate speculation that occurred over the last 7 years. Individuals purchased homes as investment vehicles, hoping to turn the house for a profit. However, in order for a house to ultimately be useful, household creation must take place. Remember, a house depreciates and is replaceable. It is a manufactured good and it costs money to keep a house in operating order. This carry cost can seriously impact return on investment. The supply of housing has barely corrected and more price declines are imminent.

Tuesday, November 25, 2008

Term Asset-Backed Securities Loan Facility (TALF)

$200 billion available for non-recourse loans, target collateral is asset based securities

$600 billion available for non recourse loans, target collateral is GSE debt/MBS

Below is some interesting text from the press release:

Eligible Borrowers

All U.S. persons that own eligible collateral may participate in the TALF. A U.S.

person is a natural person that is a U.S. citizen, a business entity that is organized

under the laws of the United States or a political subdivision or territory thereof

(including such an entity that has a non-U.S. parent company), or a U.S. branch or

agency of a foreign bank.

FDIC Quarterly Banking Profile

New Bad Bank List

Monday, November 24, 2008

Citi Is Not The Only One Who Never Sleeps....

-- The Treasury Department will purchase $20 billion of preferred stock, funds will come from the TARP. The quarterly, 8% dividend is cumulative. In addition, the Treasury will receive 10 year warrants for the purchase of $2 billion of common shares. The strike price on the warrants is $10.61.

-- Citigroup, Inc. will issue an additional $4 billion of the preferred to the Treasury and $3 billion to the FDIC as payment for a limit on asset losses. This pool of assets is comprised of residential (10 year window) and commercial (5 year window) mortgage related loans and securities, a total of $306 billion worth. Citi will absorb the first $29 billion of losses (pre-tax), after which the the government will absorb 90% of further losses. Since Citi is only on the hook for 10% of the further losses, the risk weighting will be lowered to 20%. This has the effect of adding $16 billion of capital to Citi's reserves. Citi will also be able to count $3.5 billion of the "put premium" as capital.

-- The Federal Reserve has agreed to extend Citi a non-recourse loan to backstop the positions. Should the loan become exercised, the rate would be OIS + 300 basis points.

-- Citi also agrees to a government approved executive compensation plan and common stock dividend policy. The dividend is limited to $0.04 per year for the next three years, unless approved by the government.

Equity futures are pointing to a 1% rally, Citi shares have traded over $5 in Germany.

Saturday, November 22, 2008

Another Look at Citigroup, Inc.

- earnings per share of $0.70 for 2009, increasing at about 5.2% per year through 2014

- dividend per share drops to $0.14 for 2009, 20% payout rate

- book value per share of $10.81 to begin 2009, currently reported at around $17.85

That would do it. The consensus analyst EPS forecast (revised downward dramatically this week) for 2009 is $0.76 and a dividend cut seems to be in the offing. That leaves asset valuation as the key component.

Friday, November 21, 2008

...And The Hits Just Keep on Coming

http://www.fdic.gov/bank/individual/failed/banklist.html

Tuesday, November 18, 2008

ABX & CMBX: Indicies at All Time Lows

Asset backed security (ABS) is the market term for these bonds, although the term is usually used when describing bonds backed by credit card loans or auto loans. Mortgage backed securities (MBS) and commercial mortgage backed securities (CMBS) describe bonds backed by residential and commercial mortgages respectively. Please drop me a line if anyone is interested in a more expansive post, the subject deserves it. Much like a gun, securitization can be an extremely helpful tool. However, we all know the devastation a gun can wreak in the wrong hands.

ABX is an asset backed security index and CMBX is a commercial mortgage backed index. There are several tranches for each, divided by loan vintage and credit ratings. A trader or speculator can take a long or short position in the index.

ABX pricing is similar to the way a typical bond is priced. The ABX index rises when the underlying credit improves, i.e. the likelihood of default decreases.

CMBX trades on a credit spread basis. When the index rises, the underlying credit deteriorates (the likelihood of default increases).

I bring this up because EVERY SINGLE ABX AND CMBX TRANCHE IS TRADING AT THEIR ALL TIME WORST LEVELS. Market participants clearly do not want to hold credit risk in their portfolios.

Note, there is no ABX tranche for 2008 issuance. THAT IS BECAUSE THERE HAS BEEN SO LITTLE ISSUANCE TO HEDGE.

The problem is simply stated below. It represents the holdings of Federal Reserve primary dealers. Primary dealers are authorized to trade directly with the Federal Reserve. For a list, click the below link. The run-up in risky assets speaks volumes about the issues the financial markets are facing today.

http://www.ny.frb.org/newsevents/news/markets/2008/an081001.html

Monday, November 17, 2008

CDS Settlement for the Nationalized Icelandic Banks

Bank | Senior Debt | Subordinated Debt |

Value | Value | |

Landsbanki | 1.250% | 0.125% |

Glitnir Bank | 3.000% | 0.125% |

Kaupthing Bank | 6.625% | 2.375% |

Saturday, November 15, 2008

TARP Infusion Recap: $250 billion Allocation

List is comprised of distributions of $200 million or greater. Although the $40 billion going to AIG is from the TARP, it is not being taken from this allocation. Remember, the $700 billion EESA of 2008 was broken into tranches. The President needs to sign off on the next $100 billion installment: this is where AIG will get the funds.

The Bernanke Hotel & Casino

-- The Federal Reserve System holds $52.84 in assets for each dollar of capital

-- Their holdings of U.S. Treasury securities have decreased by $303 billion in 1 year

-- Other loans (this includes broker/dealer loans, the asset backed commercial paper liquidity program and the initial AIG loan) total $316 billion

-- The U.S. Treasury has now supplied the Fed with $559 billion via the Supplementary Financing Program (unchanged versus last week). Please check the 10/8/08 post "Some Bullet Points" for Program details.

Credit Drops ==> Retail Sales Drop ==> GDP Drops

As I have noted in previous posts, consumer borrowing is grinding to a halt. Whether it is forced or voluntary, the decline in leverage will have a profound impact on retail sales going forward. To quickly review, outstanding household mortgage debt grew from $4.8 trillion in 2000 to $10.5 trillion in 2007. However, it has expanded by only $200 billion this year (my forecast based on Federal Reserve 3rd quarter data). Outstanding consumer credit grew from $1.7 trillion in 2000 to $2.6 trillion in 2007. My guess is that it will expand to $2.7 trillion by year end since credit providers did not aggressively cut access until the third quarter.

Last year's $4.5 trillion represented 32% of GDP. The consumer is a huge part of our economy. Be prepared for an extended economic downturn.

Bad Bank Alert

http://www.myfdicinsurance.gov/

Friday, November 14, 2008

How Much is Citigroup Worth?

Current book value is $17.12, but I dropped that by 20%: $14.26

Earnings per share: I used $1.14 for full year 2009

Return on Equity: 8%

I assumed no dividend cut

Dividend payout rate of 20% for the next 3 years, increasing a bit after that

Cost of capital assumption: 12.7%

$8.37 per share

Thursday, November 13, 2008

Equity Market Bottom Re-Revisited

Volume for the DJIA was respectable at 475 million shares traded, implying some interest in going long. I will post more details in a bit.

| Largest One Day Point Increases | |||

| Date | Closing Value | Change (points) | Change (%) |

| 10/13/2008 | 9,387.61 | 936.42 | 11.08% |

| 10/28/2008 | 9,065.12 | 889.35 | 10.88% |

| 11/13/2008 | 8,835.25 | 552.59 | 6.67% |

| 03/16/2000 | 10,630.60 | 499.19 | 4.93% |

| 07/24/2002 | 8,191.29 | 488.95 | 6.35% |

| 09/30/2008 | 10,850.66 | 485.21 | 4.68% |

| 07/29/2002 | 8,711.88 | 447.49 | 5.41% |

| 03/18/2008 | 12,392.66 | 420.41 | 3.51% |

| 03/11/2008 | 12,156.81 | 416.66 | 3.55% |

| 10/20/2008 | 9,265.43 | 413.21 | 4.67% |

| | | | |

| Largest One Day Percentage Increases | |||

| Date | Closing Value | Change (points) | Change (%) |

| 03/15/1933 | 62.10 | 8.26 | 15.34% |

| 10/06/1931 | 99.34 | 12.86 | 14.87% |

| 10/30/1929 | 258.47 | 28.40 | 12.34% |

| 06/22/1931 | 145.82 | 15.51 | 11.90% |

| 09/21/1932 | 75.16 | 7.67 | 11.36% |

| 10/13/2008 | 9,387.61 | 936.42 | 11.08% |

| 10/28/2008 | 9,065.12 | 889.35 | 10.88% |

| 10/21/1987 | 2,027.85 | 186.84 | 10.15% |

| 08/03/1932 | 58.22 | 5.06 | 9.52% |

| 09/05/1939 | 148.12 | 12.87 | 9.52% |

Wednesday, November 12, 2008

Another Addition to the Big Drop List: DJIA

| Largest One Day Point Declines | |||

| Date | Closing Value | Change (points) | Change (%) |

| 09/29/2008 | 10,365.45 | -777.68 | -6.98% |

| 10/15/2008 | 8,577.91 | -733.08 | -7.87% |

| 09/17/2001 | 8,920.70 | -684.81 | -7.13% |

| 10/09/2008 | 8,579.19 | -678.91 | -7.33% |

| 04/14/2000 | 10,305.77 | -617.78 | -5.66% |

| 10/27/1997 | 7,161.15 | -554.26 | -7.18% |

| 10/22/2008 | 8,519.21 | -514.45 | -5.69% |

| 08/31/1998 | 7,539.07 | -512.61 | -6.37% |

| 10/07/2008 | 9,447.11 | -508.39 | -5.11% |

| 10/19/1987 | 1,738.74 | -507.99 | -22.61% |

| 09/15/2008 | 10,917.51 | -504.48 | -4.42% |

| 09/17/2008 | 10,609.66 | -449.36 | -4.06% |

| 03/12/2001 | 10,208.25 | -436.37 | -4.10% |

| 02/27/2007 | 12,216.24 | -416.02 | -3.29% |

| 11/12/2008 | 8,282.66 | -411.30 | -4.73% |

| | | | |

| Largest One Day Percentage Declines | |||

| Date | Closing Value | Change (points) | Change (%) |

| 10/19/1987 | 1,738.74 | -507.99 | -22.61% |

| 10/28/1929 | 260.64 | -40.58 | -13.47% |

| 10/29/1929 | 230.07 | -30.57 | -11.73% |

| 10/05/1931 | 86.48 | -10.40 | -10.73% |

| 11/06/1929 | 232.13 | -25.55 | -9.92% |

| 08/12/1932 | 63.11 | -5.79 | -8.40% |

| 01/04/1932 | 71.59 | -6.31 | -8.10% |

| 10/26/1987 | 1,793.93 | -156.83 | -8.04% |

| 10/15/2008 | 8,577.91 | -733.08 | -7.87% |

| 06/16/1930 | 230.05 | -19.64 | -7.87% |

| 07/21/1933 | 88.71 | -7.55 | -7.84% |

| 10/09/2008 | 8,579.19 | -678.91 | -7.33% |

| 10/18/1937 | 125.73 | -9.75 | -7.20% |

| 10/27/1997 | 7,161.15 | -554.26 | -7.18% |

| 10/05/1932 | 66.07 | -5.09 | -7.15% |

Au, Ag, Pt, Pd Derivatives

Wow indeed. According to the Office of the Comptroller of the Currency's June 30, 2008 report, commercial bank and trust companies hold $134.85 billion in gold and precious metals derivatives. JPM holds $96.15 billion of that total.

According to the U.S. Mint, the depository at Fort Knox hold 147.3 million troy ounces of gold (exactly who owns that gold is a subject for another post). Using $723.00 as the price per ounce, the value would be $106.5 billion. The Federal Reserve Bank held 266 million troy ounces in 2004, according to their publications. Once again, the Fed safeguards the gold for other countries and entities, so the entire balance is not owned by the U.S.

I Guess Paulson Reads This Blog

http://www.bloomberg.com/apps/news?pid=20601087&sid=aUBsSA1_p9aQ&refer=home

Consumer credit will now be the focus of the remaining bullets in the TARP gun.

Tuesday, November 11, 2008

Equity Bottom Revisited

A few posts back (10/10/08), I made note of the 8,000 level on the Dow Jones Industrial Average as a key support level. The index hit an intraday low of 7,773.71 on that day and hit an intraday low of 8,085.37 on 10/27/08. Let's see if the fundamentals tie out with this technical support level.

For this exercise I will use the S&P 500 as the equity market proxy because data is more readily available.

- Quarterly earnings peaked in the 2nd quarter of 2007 at $84.95

- S&P is forecasting earnings of $48.52 for the 4th quarter of 2009

- I think that forecast is a bit aggressive. Based on past peak to trough earnings swings, I am estimating earnings for the last quarter of 2009 will be $39.93

- The average earnings yield for the S&P 500 for the last 20 years is 4.886%

- $39.93 / 4.886% = 817.23

A bottom of 817.23 in the S&P 500 would roughly tie out to a level of 7,903.60 in the Dow, which is obviously pretty close to the technical support level. These levels would correspond to a drop of 9.09% from Tuesday's close and a drop of roughly 46% from the all-time highs set back in October, 2007.

I still believe that one must assign some probability to a scenario that drives corporate earnings even lower than my estimates. Therefore, I would not suggest a 100% portfolio exposure to equities, even at the support level. In the coming weeks, I would expect another test of the support level.

Monday, November 10, 2008

Another Bubble Will Burst

The market has grown considerably over the last 30 years. Technological advances (increased bandwidth, Internet, etc.) have contributed to the expansion. In addition, the growth of the loan securitization markets has aided as well.

The market has grown considerably over the last 30 years. Technological advances (increased bandwidth, Internet, etc.) have contributed to the expansion. In addition, the growth of the loan securitization markets has aided as well. The asset backed securities market is currently the second largest holder of these loans. It trails only the commercial banks in this regard. The importance of this market is clear from the graph on the right.

The asset backed securities market is currently the second largest holder of these loans. It trails only the commercial banks in this regard. The importance of this market is clear from the graph on the right. However, it is also clear from both graphs that the demand for these assets as collateral for structured bonds peaked in 2003. Obviously, consumer credit continued to grow since then, meaning that originators were probably holding a larger proportion of their loans. The key is then what can be said about the quality of this collateral?

However, it is also clear from both graphs that the demand for these assets as collateral for structured bonds peaked in 2003. Obviously, consumer credit continued to grow since then, meaning that originators were probably holding a larger proportion of their loans. The key is then what can be said about the quality of this collateral? Well, the data to the left and below describe both loan maturity and loan to value characteristics of automobile loans. Longer dated and more levered loans prevailed until the last few months.

Well, the data to the left and below describe both loan maturity and loan to value characteristics of automobile loans. Longer dated and more levered loans prevailed until the last few months. On another note, it becomes easy to see why the automobile manufacturers are having such a difficult time. They relied on easy credit terms to "forward sell" inventory.

On another note, it becomes easy to see why the automobile manufacturers are having such a difficult time. They relied on easy credit terms to "forward sell" inventory.Recent earning reports have also clued us in to the issues facing consumer credit. Citigroup's North American credit card division (3rd quarter, 2008) experienced a 35% annual increase in managed loans 90 or more days past due. Managed net credit losses increased by 63%.

American Express increased loss provisions by almost $1 billion in the 3rd quarter and reported a net-loan write off rate of 5.9% for their managed loans. The rate stood at 3% the year before.